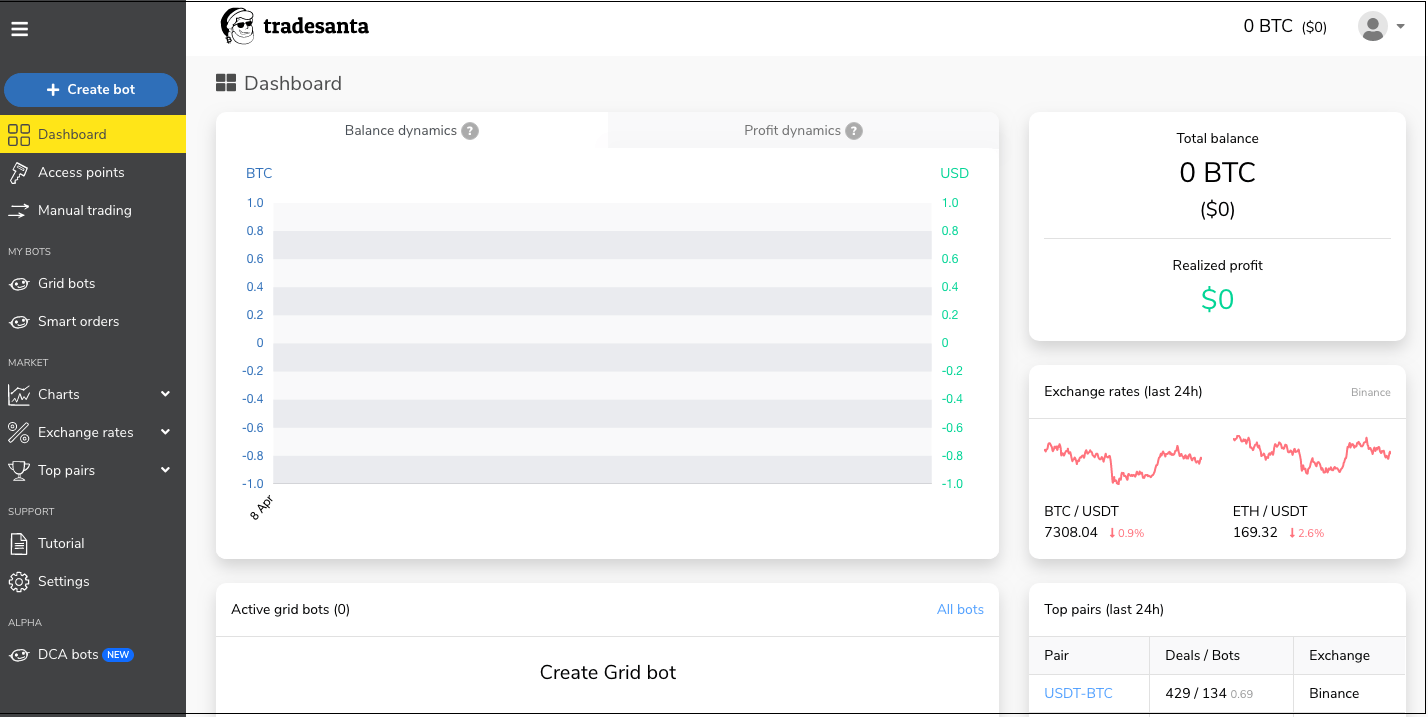

Tradesanta Bot

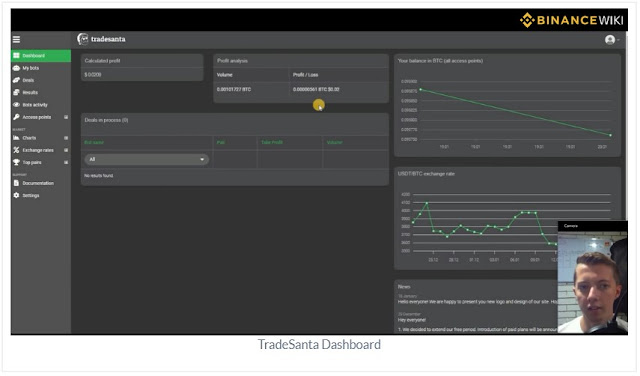

Tradesanta es un software de comercio de criptomonedas en la nube que le permite aprovechar las fluctuaciones del mercado de criptomonedas.

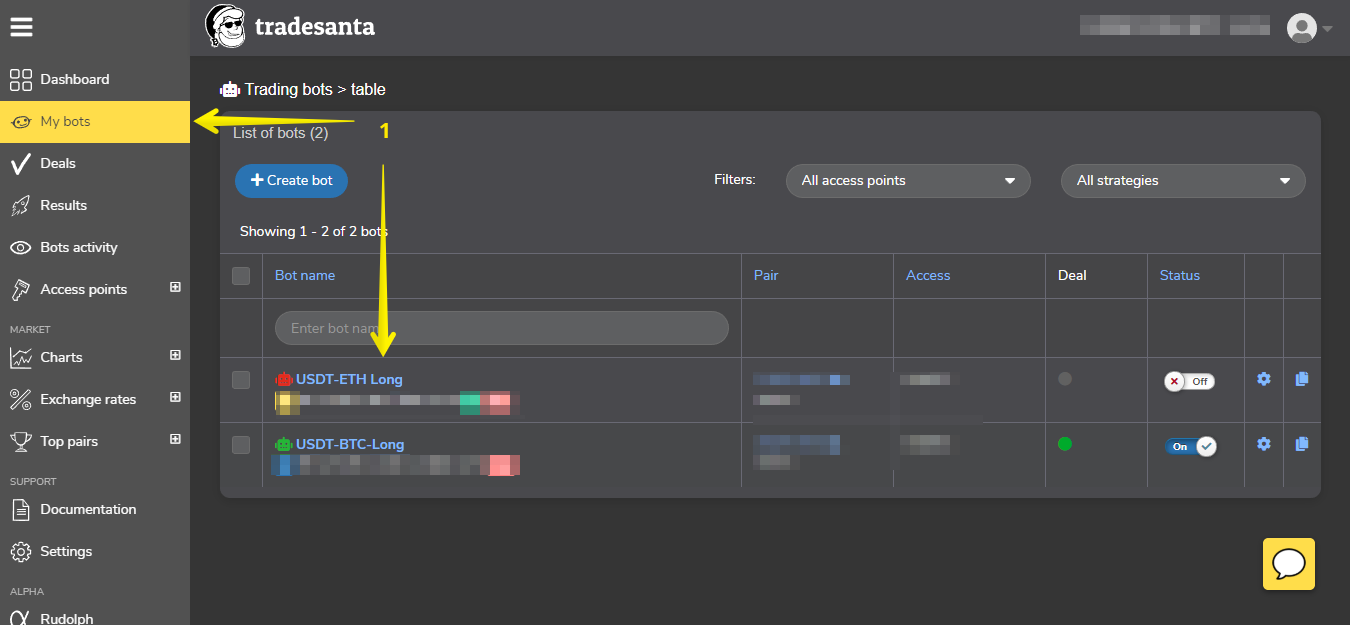

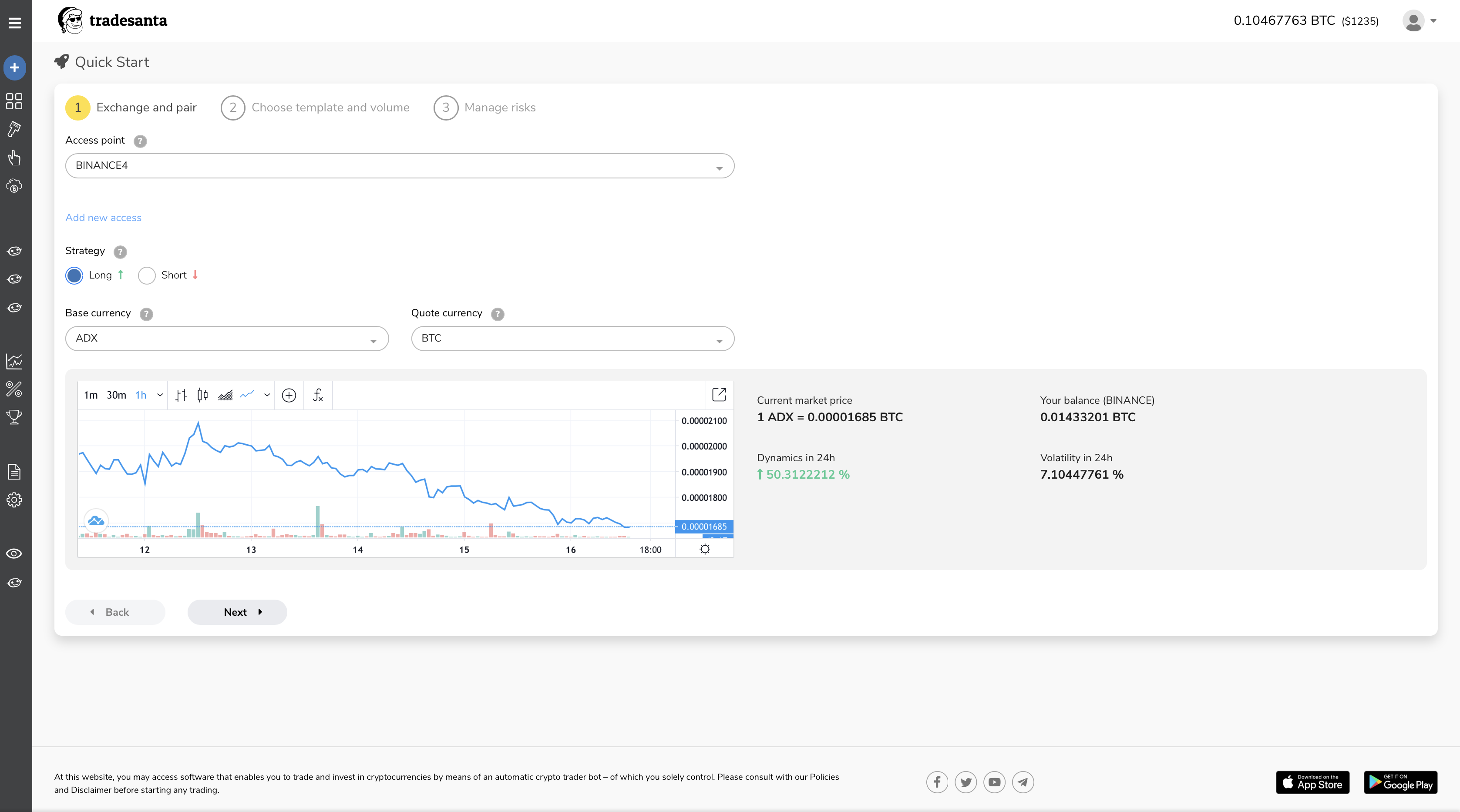

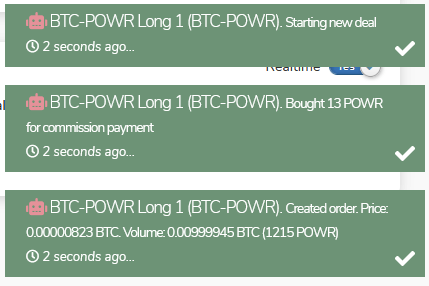

Tradesanta bot. In this article we ll explain it using a long strategy as an example. How does tradesanta work. Rsi tradesanta s bot will find an entry point based on rsi of a trading pair for the past 100 minutes. Conecte tradesanta a su intercambio y opere las 24 horas del día los 7 días de la semana sin que sea un trabajo a tiempo completo.

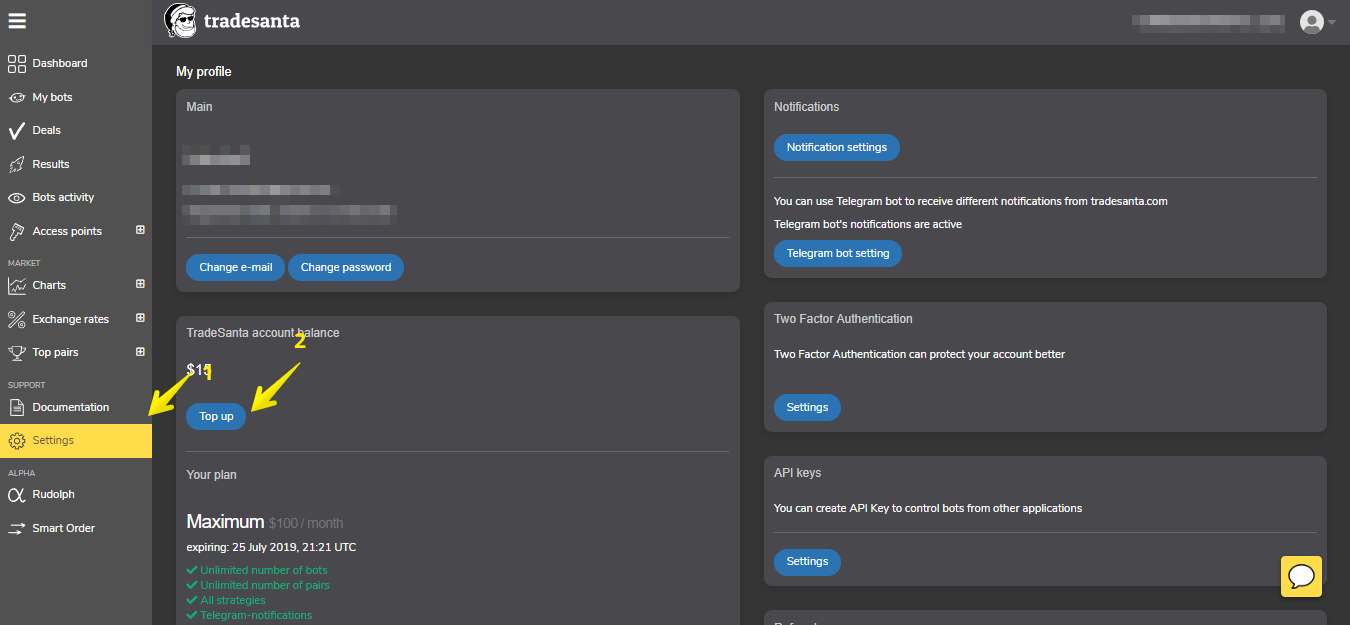

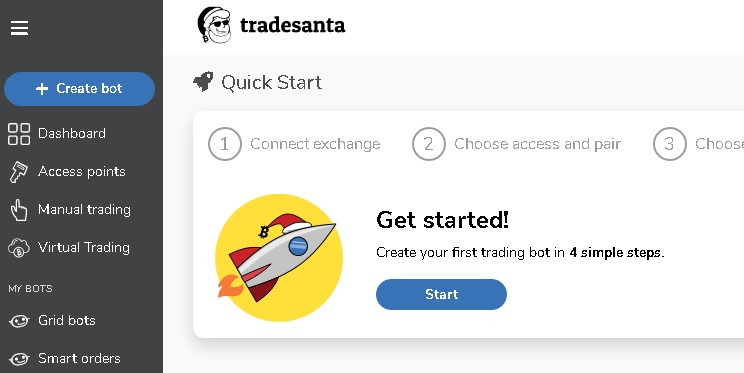

It takes only a few minutes to set up a cryptocurrency bot. Empezar la prueba gratuita. Tradesanta is a cloud software platform that automates crypto trading strategies. Rsi is a momentum indicator signalling if the stock is oversold or overbought.

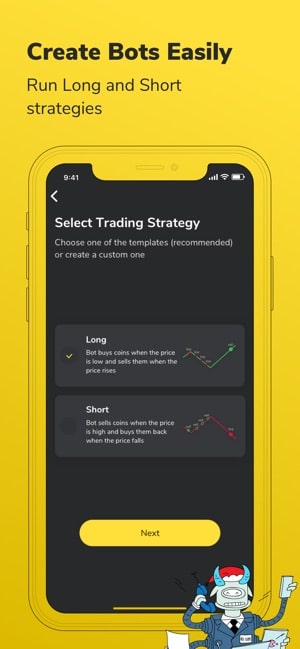

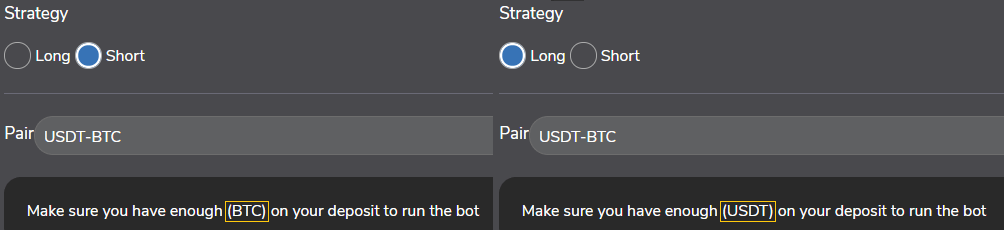

Tradesanta offers two kinds of trading bots. Tradesanta is a cloud based crypto trading platform that allows to create and manage bots according to the user s strategy tradesanta focuses on simple user interface and automating well known strategies. For the first order crypto bot buys the amount of base currency indicated in the settings by the user. In long strategy the bot buys the coins in order to sell when the price goes up to get the profit.

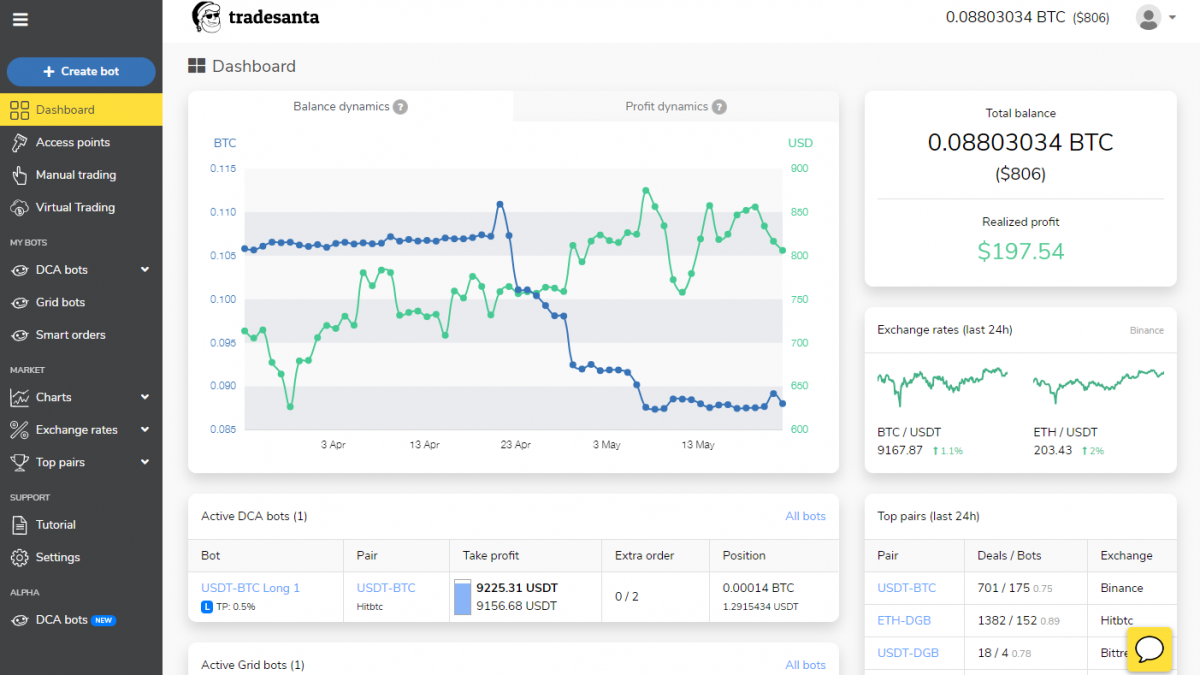

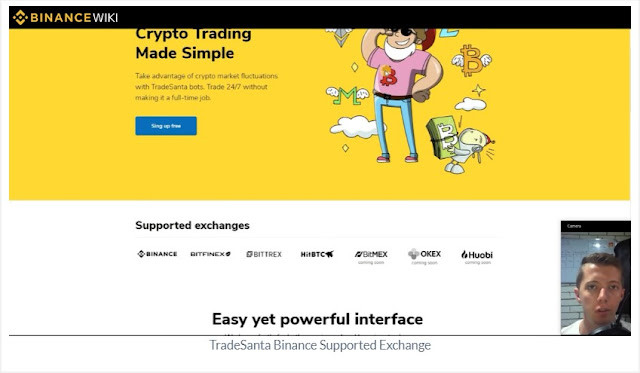

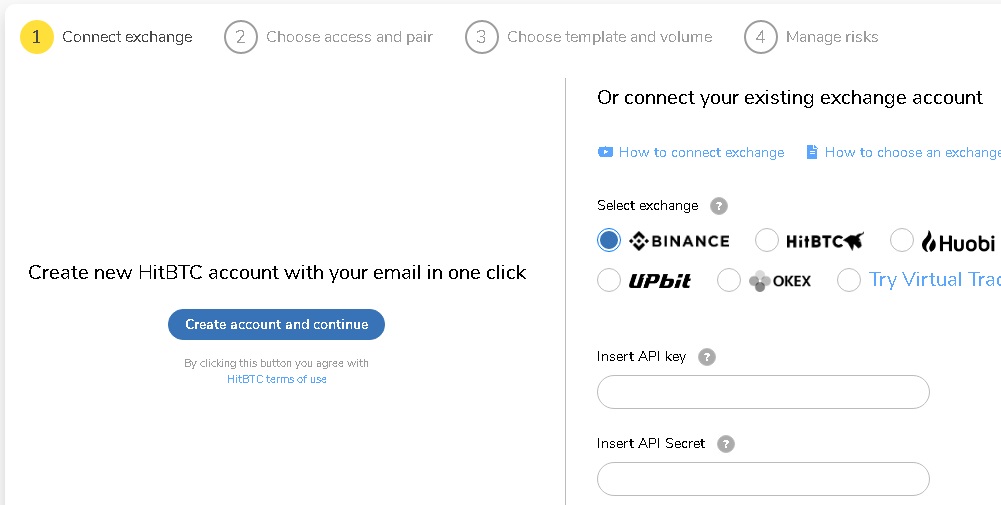

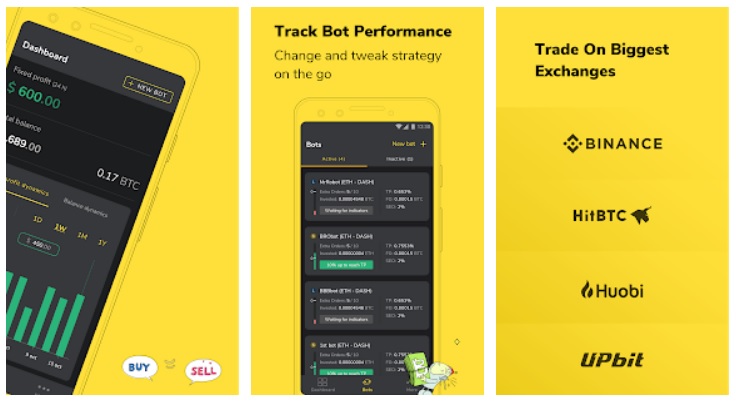

Grid and dca bots. Cryptocurrency trading bots are available for binance hitbtc okex huobi upbit. Macd bot will search for an optimal entry point based on macd of a trading pair for the past 100 minutes. The recommended amount of volume for both btc and eth pairs is 100 units which should be enough to ensure there is enough liquidity to exit trades and cushion against major swings that could trigger a stop loss sale.

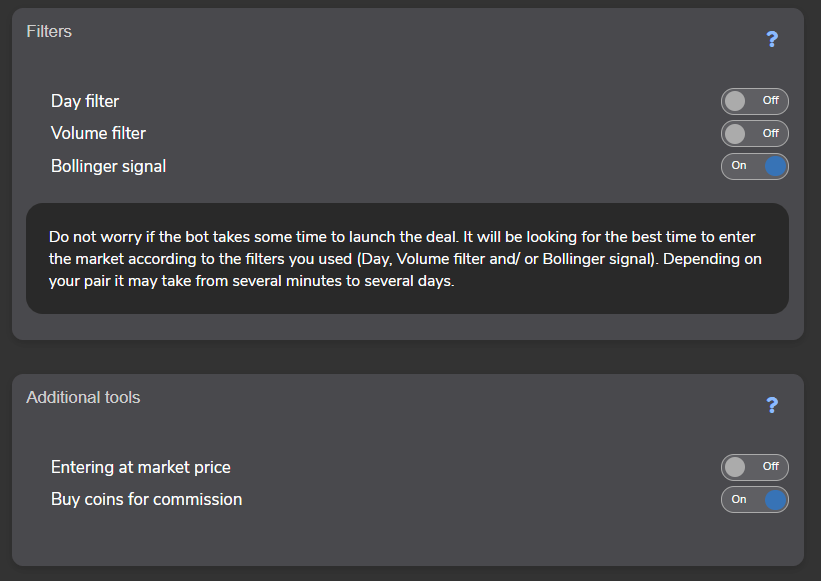

Tradesanta cloud software automates well known trading strategies on major crypto exchanges including binance hitbtc huobi and upbit. Macd is an indicator used to confirm the trend. Once your trading bot is set up and ready to buy and sell cryptocurrencies it will open a deal either immediately or after a signal from technical indicators is received depending on the filters set. Tradesanta s bot can be set up to enter a market if the right volume conditions are present as measured by the previous day s trading volume.